Carbon Credit Exchange Money

A lot of people have questions about where does carbon credit exchange money go. It’s important to understand that there are a number of ways you can invest in the carbon credit market. One of the easiest ways is by investing in a carbon credit ETF, which tracks the market’s performance. Another way is to invest in a carbon futures contract, which allows you to buy and sell physical carbon allowances as they are auctioned through commodities exchanges.

carbon credit exchange can also be a good investment if you think that they will increase in value over time. The price of carbon credits is often based on demand, which can be influenced by the state of the global energy market and other factors. Historically, carbon credits have been used to offset the pollution introduced into the atmosphere by large corporations. This is done through the voluntary market, which consists of individuals and businesses that purchase green projects to reduce their emissions.

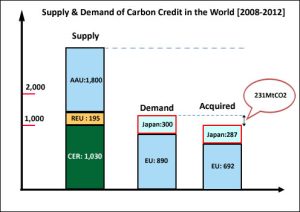

The voluntary market is expected to grow to 900 million tonnes of carbon per year by 2050. It is the largest source of carbon credits in the world, and it will continue to grow as governments implement cap-and-trade systems to help reduce global warming. Tokenization is a way to make carbon credits more accessible and liquid, by creating a stock market that has price transparency and liquidity. The market will be able to attract a greater volume of investors who are interested in reducing their carbon footprints.

Where Does Carbon Credit Exchange Money Go?

When someone purchases a carbon credit, the money from that purchase can go to a variety of places, depending on the type of credit and the organization that issued it. Generally speaking, the money generated from carbon credit exchanges can be used in one of two ways: to support emission-reducing projects or to provide financial benefits to those who have created those projects.

One common way that carbon credit exchange money is used is to support the development of emission-reducing projects. For example, a renewable energy project may generate carbon credits that are sold on an exchange. The money generated from the sale of those credits can then be reinvested in the project to help it grow and continue to reduce emissions. Alternatively, the funds may be used to support other emission-reducing projects or initiatives.

Another way that carbon credit exchange money is used is to provide financial benefits to those who have created emission-reducing projects. For example, if a company invests in a project that generates carbon credits, they can sell those credits on an exchange and use the revenue to offset their own carbon footprint. In some cases, the money generated from the sale of carbon credits can also provide financial benefits to local communities, such as through job creation or infrastructure development.

It’s important to note that not all carbon credit exchanges operate in the same way or have the same distribution of funds. For example, the United Nations’ Clean Development Mechanism (CDM) requires that a portion of the revenue generated from carbon credit sales goes to a special fund for least-developed countries. Other exchanges may have different requirements or guidelines for how the funds are distributed.

In conclusion, the money generated from carbon credit exchanges can be used in a variety of ways, including to support emission-reducing projects, provide financial benefits to those who have created those projects, and support local communities. The specific use of the funds depends on the type of credit and the organization that issued it.